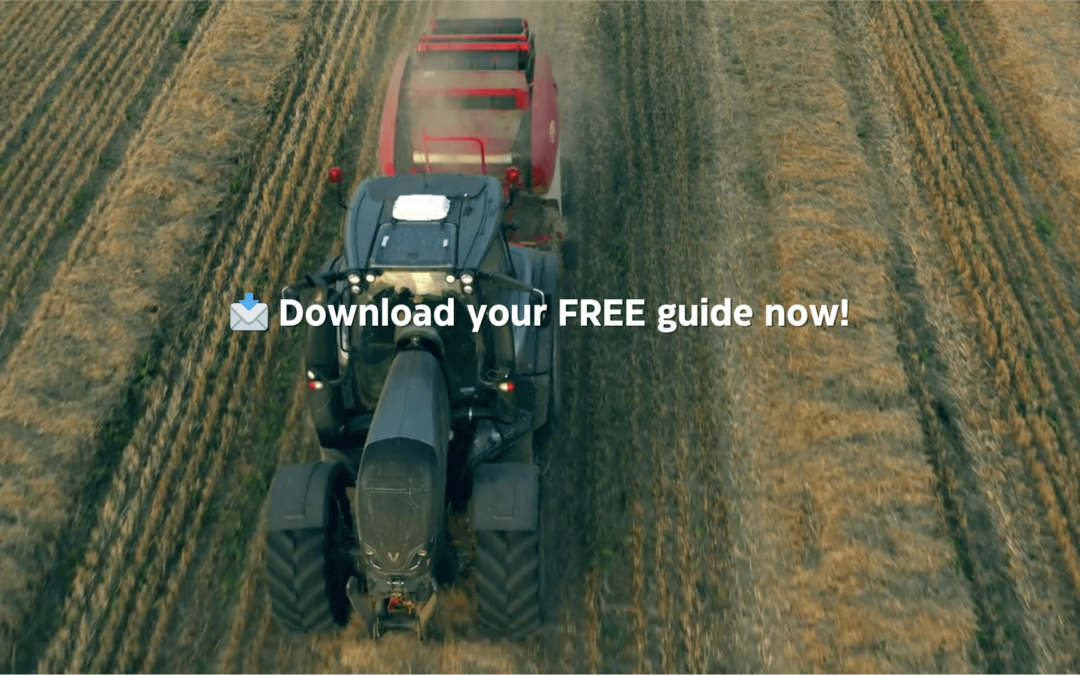

Inheritance Tax Shake-Up: What It Means for UK Farmers & Landowners

If you’re a farmer, landowner, or rural business owner, you’ve likely heard about the recent changes to Inheritance Tax (IHT) announced in the 2024 Budget. These new rules, set to take effect from April 2026, could have a significant impact on how agricultural estates...

Exciting News

Exciting News The Trusted Business Community Association Awards I’m absolutely thrilled to share that I’ve been recognised by The Trusted Business Community Association Awards! 🎉 These prestigious awards celebrate businesses that: ✅ Show outstanding growth or...

New Year, New Legacy

New Year, New Legacy Protect Your Family with a Trust in 2025 (not the offshore kind!) As the echoes of the festive season fade and we embark on a new year, many families find themselves contemplating their financial futures. Now is an ideal time to reflect on your...

Budget Update: Is Your Estate Plan Ready?

Budget Update: Is Your Estate Plan Ready? Post-Budget Alert: Important Changes That May Affect Your Estate Planning Following the Autumn Budget announcement last week, I wanted to update you all personally about some significant changes that could impact your estate...

Budget Uncertainty? One Thing Is For Sure… …You Need a Will!

Budget Uncertainty? One Thing Is For Sure……You Need a Will! With the UK Budget fast approaching, I know many of you are anxious about potential Inheritance Tax changes. The rumour mill is churning, and it’s natural to feel uncertain about what the Chancellor...

Protecting Vulnerable Loved Ones: The Power of Trusts in Estate Planning

Are you concerned about the financial well-being of a loved one who might face challenges managing their inheritance? Perhaps it’s a minor, a family member with a disability, or someone simply not adept at handling finances. If so, trusts can be a game-changer...

A Cautionary Tale: Don’t Miss Out on Your Residence Nil Rate Band

A recent client case highlighted a common oversight that could cost your loved ones dearly in Inheritance Tax (IHT). I recently reviewed wills for a client and discovered the following… The client, a sole owner of their main home, had left everything to her husband,...

The Silent Threat to Your Children’s Inheritance

I want to share a particularly alarming trend I’ve observed: long-term separated couples inadvertently disinheriting their children. This scenario is more common than you might think, and the consequences can be devastating for families.

Reclaiming the Trust: A Legacy Beyond Privilege

Are trusts merely instruments for the wealthy elite to hoard their fortunes? This outdated notion overlooks the myriad legitimate and socially beneficial purposes they serve. Trusts, with origins dating back to the Crusades, have been a cornerstone of estate planning.

Don’t miss out: Free review worth £200+ in August

Your Complimentary Will Review Awaits: For the month of August only, I’m offering a select number of complimentary will reviews to my valued subscribers. This service, typically priced at £200 per person or £300 per couple, is available to you at no cost.

Trusts: A Shield for Family Businesses and Agricultural Assets

In an era of potential legislative changes and economic uncertainty, protecting your family business or agricultural assets has never been more crucial. Recent reports suggesting that the new government might consider removing certain inheritance tax reliefs have sent ripples of concern through the business community. However, there’s a powerful tool at your disposal that can help secure your legacy: trusts.

Unregulated Will Writers

The Hidden Dangers of Unregulated Will Writers: Why Professional Expertise Matters

In an era where DIY solutions seem to abound for every aspect of our lives, it’s tempting to consider cutting corners when it comes to estate planning and will writing.

Ever wondered how the Rich & Famous navigate the complexities of Estate Planning and IHT?

Join me and guest co-host Siân Bushell as we unveil secrets to building a thriving legacy and minimising taxes.

Secure Your Agricultural Legacy & Minimise Taxes: Free Webinar (Open to All!)

Join me and guest co-host Siân Bushell as we unveil secrets to building a thriving legacy and minimising taxes.

Navigating the UK Inheritance Tax Landscape – What You Need to Know

Inheritance Tax (IHT) in the UK often sparks a flurry of questions and concerns among those planning their estates or dealing with inheritance. Despite its significant impact on many, the recent UK Spring Budget announcement by the Chancellor left the regulations surrounding Inheritance Tax unchanged, including the key thresholds known as the Nil Rate Band and Residence Nil Rate Band.

Is your Will outdated? 11 questions you need to ask yourself

It is vitally important to make a Will and equally as important to ensure you regularly review your plans to ensure that your Will is up to date. It may be some years since you wrote your Wills, but there are now many changes you need to consider.

Don’t Let Your Will Be Invalid

As a seasoned professional in Wills, Legacies, Powers of Attorney, Estate Planning, and assisting families in ensuring that wealth is passed down to future generations, I have seen my fair share of estate planning mishaps. But one recent case really struck a chord with me and I feel compelled to share it with you.

The 2023 Autumn Statement

The 2023 Autumn Statement How Rumoured Inheritance Tax Could Impact Your Legacy As chancellor Jeremy Hunt puts the finishing touches on his upcoming Autumn Statement on Wednesday 22nd November, speculation is swirling about a potential cut to inheritance...