The 2023 Autumn Statement

Don’t Let Your Will Be Invalid

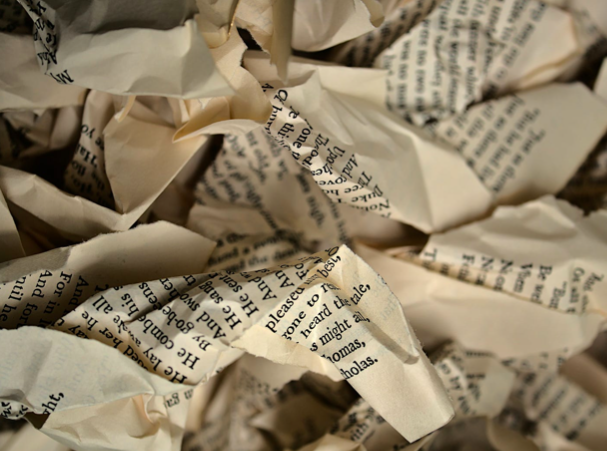

The Dangers of Gambling with Your Legacy

As a seasoned professional in Wills, Legacies, Powers of Attorney, Estate Planning, and assisting families in ensuring that wealth is passed down to future generations, I have seen my fair share of estate planning mishaps. But one recent case really struck a chord with me and I feel compelled to share it with you.

I recently spoke with a son whose father had passed away. His father had taken the time to draft a Will, outlining his wishes for the distribution of his estate. However, there was one crucial detail that was overlooked – the Will had not been signed! 😨 As a result, the Will was deemed invalid and the father died intestate.

This is a heartbreaking situation for any family to find themselves in. Not only are they dealing with the loss of a loved one, but now they must navigate the complex and often frustrating process of intestacy.

So, what can you do to prevent this from happening to you and your family? The first step is to understand what makes a Will valid.

In the UK, a valid Will must meet the following requirements:

-

It must be in writing.

-

The person making the will (the testator) must sign the will in the presence of two witnesses who are both over 18 years old and not beneficiaries of the will.

-

The testator must be over 18 years old too, and have the mental capacity to understand what they are doing.

-

It’s important to note that witnesses cannot be beneficiaries of the Will or be married to a beneficiary. If they are, their gifts will be void.

How Can You Prevent a Similar Mistake?

To prevent a similar mistake, it’s important to review your planning regularly and ensure that your will is up to date and valid. Here are some tips to help you:

-

Make a will: The first step is to make a will. This will ensure that your assets are distributed according to your wishes.

-

Review your will regularly: It’s important to review your will regularly, especially if your circumstances change. For example, if you get married, divorced, or have children, you may need to update your will.

-

Keep your will safe: Once you have made your will, it’s important to keep it safe. You can leave it with a solicitor, bank, or store it safely at home.

-

Let your executors know where your will is kept: It’s important to let your executors know where your will is kept so that they can find it when the time comes.

-

Destroy old wills: If you have an earlier will, you should destroy it to avoid any confusion.

If you’re unsure about the validity of your Will or if you need help with estate planning, don’t hesitate to reach out to me. At The Inheritance Guru (https://theinheritanceguru.com), I offer complimentary consultations to help you get started. You can also contact me by email at [email protected] or by phone on 07831 379562.